cumulative preferred stock formula

In this case we have the rate of dividend and par value is given now we can calculate a preference dividend using the formula. If your preferred shares pay a 6 dividend rate and have a par value of 25 you can determine the cumulative dividends with the three steps discussed above.

For this reason the cost of preferred stock formula mimics the perpetuity formula closely.

. Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past the dividends owed must be paid out to. The preferred stock is cumulative. However such stocks are.

If net income for the 2015 2016 and 2017 were 45 million 85 million and 10 million. It has been determined that based on risk the discount rate would be 5. An individual is considering investing in straight preferred stock that pays 20 per year in dividends.

Related

On the preferred stock prospectus he notices that the dividend rate is 5 with a par value of 100. Rp cost of preferred stock with growth DY1 preferred stock dividend at year 1 P preferred stock price Growth rate. K is equal to the dividend you receive on your investment.

Annual dividend on preferred stock. Formula Examples Worksheet 1. The preferred stock is noncumulative.

The formula in such instruments for calculating its dividend is as follows. Assume you have a. The formula is k i - g v 2 In this equation.

Once all cumulative preferred stockholders are paid 200 the company. Importance of determining preferred stock cost. So lets look at an example highlighted by the Corporate Finance.

Preferred Dividend Rate The rate that is fixed by the company while issuing the shares. Cost of Preferred Stock Preferred Stock Dividend Per Share DPS Current Price of Preferred Stock. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P.

4 200 1 - 008 22. In other words par value is the face. Heres an easy formula for calculating the value of preferred stock.

Suppose cumulative preferred stock with a 10 dividend rate and a 1000 par has been issued. The preferred stockholders must be paid 120 in arrears along with the current year dividend of 80. Convertible preferred stock is preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares usually any time.

If the cost to issue new shares is 8 then the companys cost of preferred stock is. 160000 06 9600 1. Annual Dividend Ratevalue at par.

The preferred stock is cumulative. Cost of Preferred Stock Formula. Similar to common stock preferred stock is typically.

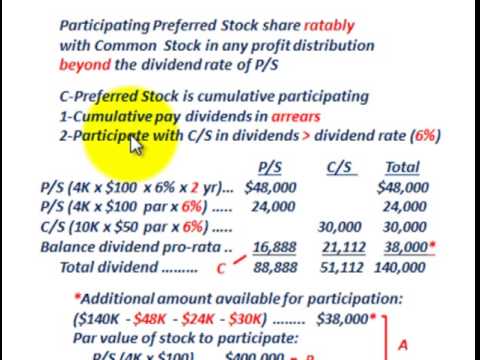

Cumulative Dividend Formula Preferred Dividend Rate Preferred Share Par Value. Cumulative preferred stock is a class of shares wherein any unpaid or undeclared dividends for the current year must be accumulated and paid for in the future. Print Cumulative Preferred Stock.

I is the rate of return you require on your investment also called. Annual preferred stock dividend Par value x Dividend rate. Cumulative preferred stock not only pays current dividends but it also must eventually pay out any suspended dividends.

Dividend formula of Cumulative preference shares. Rp D dividend P0 price For example. Cumulative preferred stock is an equity instrument that pays a fixed dividend on a predetermined schedule and prior to any distributions to the holders of a companys common.

Therefore it is not completely certain a preferred stock investor will not receive dividends. The Cost of Preferred Stock Formula. The preferred stock dividends formula is par.

There are several simple formulas an investor in. If the preferred stock is. Find out preferred dividends paid in each year and the.

If Colin were to purchase 1000 preferred shares of ABC Company assuming. First calculate the preferred stocks annual dividend payment by multiplying the dividend rate by its par value. Preferred Dividend Formula Number of preferred.

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Cumulative Noncumulative Preferred Stock Youtube

Cumulative Preferred Stock Archives Business Education

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Cost Of Preferred Stock Rp Formula And Excel Calculator

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Common And Preferred Stock Principlesofaccounting Com

Corporations Dividends Retained Earnings And Income Reporting Ppt Download

Preferred Dividend Assignment Point

Preferred Dividend Definition Formula How To Calculate

Preferred Stock And Common Stock Dividend Allocations Youtube

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Retail Investor Org Nitty Gritty Ofpreferred Shares How They Work Investor Education

Cumulative Preferred Stock Define Example Benefits Disadvantages