closed end loan disclosures

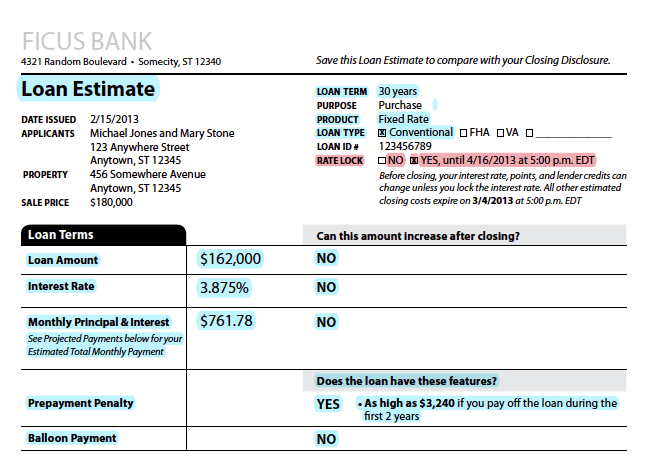

102637 Content of disclosures for certain mortgage transactions Loan Estimate. In a closed-end consumer credit transaction secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 the creditor shall provide the consumer with good faith estimates of the disclosures in 102637.

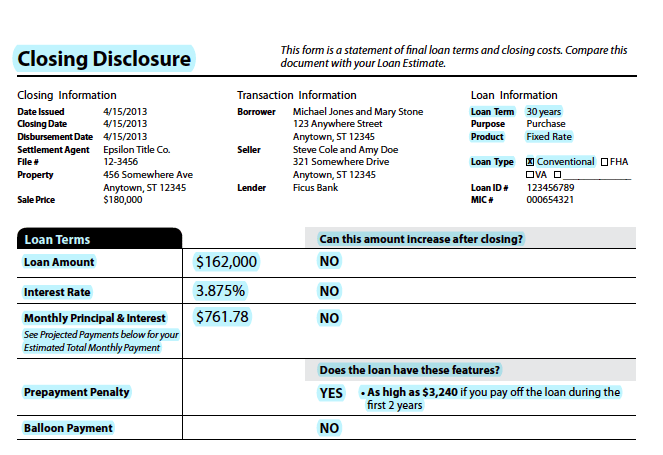

What To Know About The Loan Estimate Closing Disclosure Cd

Adopted the MDIA Final Rule for closed-end loans secured by a dwelling.

. Closed-End Credit Disclosure Forms Review Procedures. On July 23 2009 the Board issued a proposed rule to revise the rules for disclosures for closed-end credit secured by real property or a consumers dwelling. 10153D the creditor shall disclose a statement that there is no guarantee the consumer can refinance the transaction to lower the interest rate or periodic.

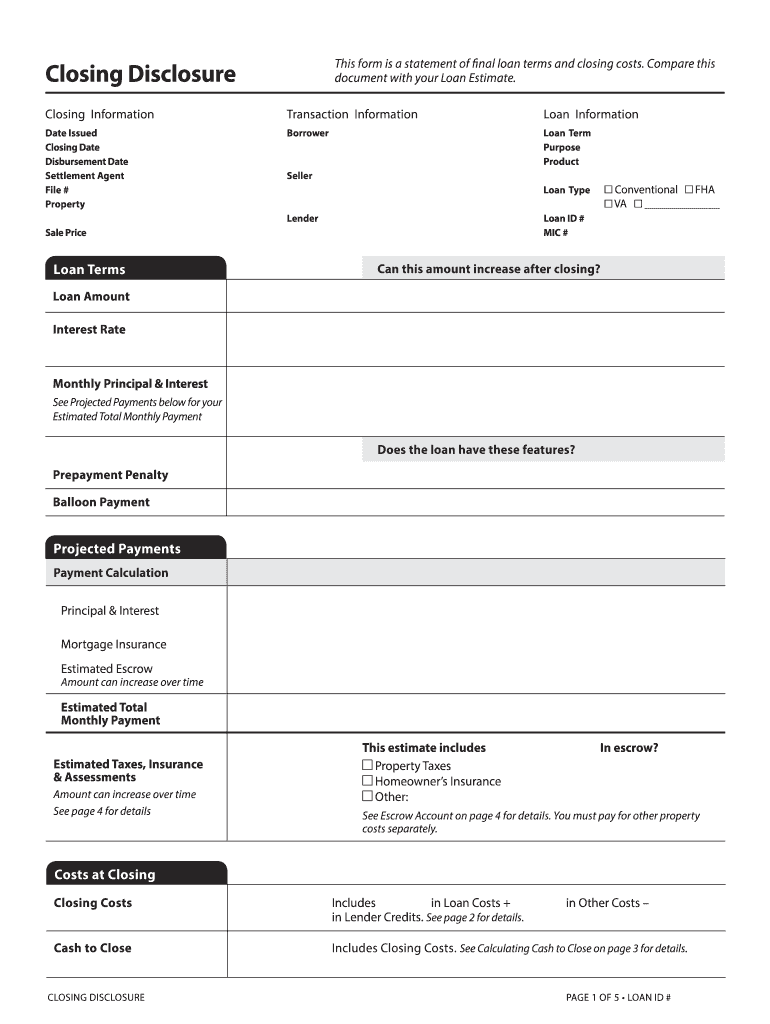

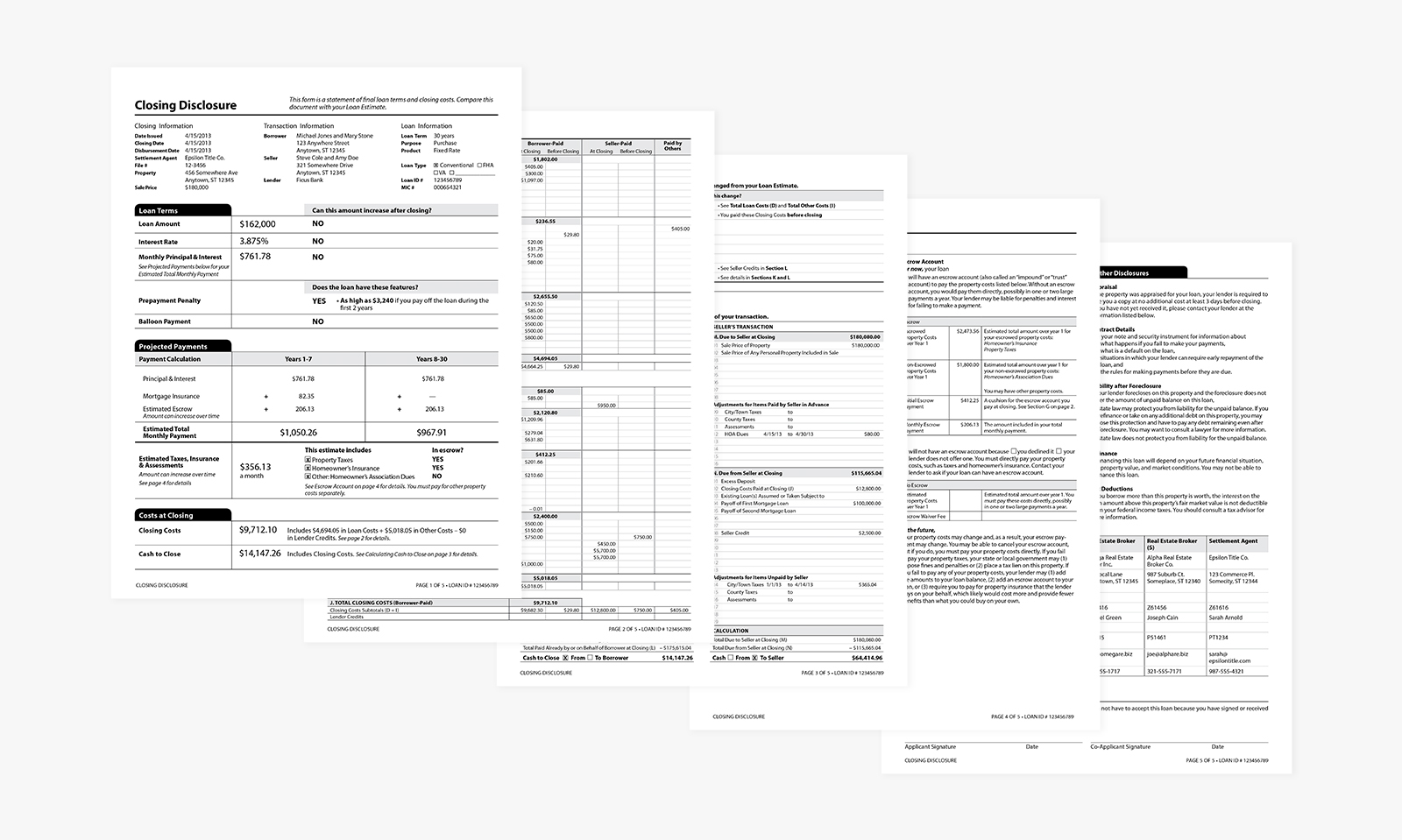

102638 Content of disclosures for certain mortgage transactions Closing Disclosure. All applications received on or after Aug. Thus for most.

For closed end dwelling-secured loans subject to. The Board also issued a proposed. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written application and at least seven 7 business days before consummation.

Section 102623a3i provides that for closed-end transactions covered by the right of rescission the consumer may exercise the right to rescind until midnight of the third business day following the last of 1 delivery of all material disclosures. For a closed-end transaction secured by real property or a dwelling other than a transaction secured by a consumers interest in a timeshare plan described in 11 USC. When an open-end account converts to a closed-end adjustable-rate mortgage the 102620c disclosure is not required until the implementation of an interest rate adjustment post-conversion that results in a corresponding payment change.

Depends on lien position. If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance with 102637c and. Only applies to loans for the purpose of purchasing or initial construction of and secured by the consumers principal dwelling.

74 FR 43232 Aug. Quick Approval Trusted Lenders. A refinancing takes place when an existing obligation is satisfied and.

And 3 delivery of the notice of the right to rescind to. Regulation Z is structured accordingly. The circumstances under which the rate for the loan may vary including disclosures of the intervals at which the lending institution may change the rate on the loan the times.

Only applies to purchase-money loans subject to RESPA. 74 FR 43232 Aug. Ad Create a Custom Loan Document to Ensure Payment Within a Specified Time Period.

Closed-End Loan Disclosures for Skip a Payment Regulation Z does not require subsequent disclosures for skip payments on closed-end loans. Federal law does not require the use of the HUD-1 or the new Closing Disclosure in all-cash transactions. Ad Our technology will match you with the best refi lenders at super low rates.

Generally the only time that new Truth in Lending Act TILA disclosures are required for closed-end loans is if a refinancing occurs. While some states have laws requiring the use of a state. If disclosures are delayed until conversion and the closed-end transaction has a variable-rate feature disclosures should be based on the rate in effect at the time of conversion.

Ad Compare Best Emergency Loans with Lowest APR. By a Consumers Dwelling Appendix G to Part 1026 Open-End Model Forms and Clauses Appendix H to Part 1026 Closed-End Model Forms and Clauses Appendix I to Part. They may decide among themselves which of them will provide the required disclosures.

The Board also issued a proposed rule to revise the. Disclosures provided on credit contracts. The integrated mortgage disclosures apply to most consumer mortgages except.

Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers Updated January 2014 Prepared by Marjorie A. The disclosure rules of Regulation Z differ depend ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by a specific date.

Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 opens new window are subject to the disclosure timing and other requirements under the TILA-RESPA Integrated Disclosure rule TRID. On July 23 2009 the Board issued a proposed rule to revise the rules for disclosures for closed-end credit secured by real property or a consumers dwelling. 1 2015 will use the new Loan Estimate and Closing Disclosure.

Create Your Loan Document in Minutes. See the commentary to 10265 regarding conversion of closed-end to open-end credit 3. For a closed-end credit transaction subject to 102619e and f opens new window real property or a cooperative unit does the credit union provide disclosures required under 102637 opens new window Loan Estimate and.

Over 15 million customers served since 2005. Special requirements for certain mortgage and variable-rate transactions. 26 2009 2009 Closed-End Proposal.

Private education loan disclosures 102647 Closed-End Credit Disclosure Forms Review Procedures. The Loan Estimate and Closing Disclosure must be used for most closed-end consumer mortgages secured by real property or a cooperative unit. 26 2009 2009 Closed-End Proposal.

And regulations concerning the treatment of credit balances how to determine annual percentage rates rights of. Subpart C dictates disclosure requirements. A Rating with BBB.

Outline Terms of Your Loan and Repayment. For disclosures with respect to private education loan disclosures see comment 47b1-2. 22619a1 and 22619a2 10.

Of the disclosures you list here would be the status in a closed-end home equity loan. On May 7 2009 the Board adopted the MDIA Final Rule for closed-end loans secured by a dwelling. Subpart AProvides general information that applies to both open-end and closed-end credit.

2 consummation of the loan. Home equity lines of credit reverse mortgages and mortgages secured by a mobile home or by a dwelling other than a cooperative unit that is not attached to real property ie. Closed-end credit is regulated throughout TILA and Regulation Z specifically in Subpart C of Regulation Z.

Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage subject to 102633. Part 33 - Variable Rate Closed-end Personal Loans. Loan Program Disclosures Cite.

Section 332 - Disclosures.

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Understanding Finance Charges For Closed End Credit

Federal Register Truth In Lending Regulation Z

New Mortgage Documents What Are They

What To Know About The Loan Estimate Closing Disclosure Cd

Closing Disclosure Form Fill Online Printable Fillable Blank Pdffiller

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Fdic Consumer News Fall 2015 Sample Disclosures Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

A Guide To Understanding Your Closing Disclosure Blumberg Blog

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)